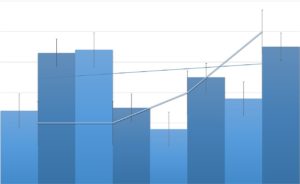

Seasonal Fluctuation of Agriculture Companies: Be More Stable With Payroll Financing!

The time to run payroll has arrived, and things don’t look so good. While you will find a way to cover it this time, will you be able to manage the next time? This is the slow season, and that means there’s not as much money coming in. Rather than wondering how you will get by until the business volume increases in a few months, it makes sense to look into the options for payroll financing. The solution that you want is Payro.

With funding from Payro, you can say goodbye to speculation about how you will pay employees on time. It’s possible to obtain funding that will help you through this season and ensure the repayment structure will make it easier to settle the funding in full once a more profitable time of year returns. Here is what you need to know about seasonality and ensuring that your company remains on a stable financing footing.

What is Meant by Seasonal Fluctuation?

Seasonal fluctuation or seasonality are terms that refer to events that take place during specific times of the year. Instead of being driven by typical economic factors that can occur at any time, these changes are directly related to certain seasons. At times, the shift will be a time when it’s possible to generate greater volumes of revenue. There may also be times of the year when sales decrease and remain somewhat depressed until after the season passes.

As this relates to agricultural companies, seasonality may have to do with the growing seasons related to certain fruits and vegetables. For example, peaches in certain parts of the country tend to be ready for picking from the end of May through the first of September. Sales during this period would tend to be greater for companies that sell or supply fresh produce.

Consumer interest may also drive seasonality. Fruits and vegetables that are associated with holiday cuisine will likely experience an uptick in the weeks prior to those holidays. That can impact the production and sales cycles for companies that supply fresh produce as well as those that make and sell frozen or canned products. During what’s known as off-seasons, the demand is at a minimum, so the volume of products produced will be lower until it’s time to ramp up for the next peak season.

Different Types of Agriculture Companies

Agriculture companies is a broad term that can cover a number of business types. Broadly speaking, any enterprise that’s engaged in the growth, gathering, processing, marketing, selling, or exporting of agricultural goods can be considered an agriculture company. A few examples include:

- Family-owned or corporate farms: An enterprise that is involved in planting, cultivating, and harvesting fruits, vegetables, or grains is often what people think of when they hear of an agricultural operation.

- Farm equipment manufacturers: Any business that makes and sells tractors, plows, balers, or other equipment used in growing and harvesting produce can be rightly included in this category.

- Agricultural marketing companies: Marketers who specialize in campaigns to promote and market farms and their products also fall into this broad category.

- Agricultural non-profit organizations: Local, regional, and national organizations that promote farm production and seek to provide discounts and other benefits to their members also qualify as agricultural entities.

These are only some examples of what can be considered an agricultural company. The bottom line is if the focus is on any aspect of growing and selling produce, the enterprise would rightly qualify.

Understanding How Seasonal Fluctuation Can Affect Your Operation

Given that growing seasons vary for different crops, the potential for experiencing at least some adverse effects of seasonal fluctuation is possible. This can be kept to a minimum by rotating crop production. In the case of manufacturers, promoting equipment that relates directly to the production of crops that are in season can also be helpful.

Even so, there’s the potential to experience a reduction in sales and subsequent income at specific times of the year. While planning can help absorb some of the temporary decrease, it may or may not cover everything. This is especially true if consumer buying habits also shift a lot during those seasons. One way to keep the business afloat is to make the most of the revenue that is coming in and use Payro payroll loans for small business to ensure all your employees are paid.

How Diminished Income Impacts The Ability to Cover The Payroll

Income levels that are lessened for a certain amount of time do present challenges. One of them is ensuring that employees continue to work and get paid without fail. With less revenue to work with, keeping payroll up to date while covering other business expenses may be more of a juggling act.

Paying your employees is always a priority. For this reason, you need resources to ensure that their paychecks are never delayed. The right approach to funding will mean that there is money set aside for payroll, and you get to use the rest of the income to take care of other business-related obligations.

And What a Delayed Payroll Can Mean For Your Company’s Future

Is a delayed payroll all that important? The fact is that this type of situation, even during a seasonal fluctuation, can have repercussions long after the season passes and demand for your goods and services picks up again. Choosing to avoid any payroll issues will go a long way toward helping you avoid those issues.

An immediate effect of delaying the payroll is that employees lose confidence in the employer. Faced with concerns about paying their own bills, the formerly warm feelings toward the company fade a little. It will take some time for those feelings to be restored.

Some employees will see the delayed payroll as a red flag that the business is in danger. While some may resolve to stick around and see what happens, others will begin looking for jobs elsewhere. If they do leave, that means finding the funds to invest in hiring and training new employees.

Even if everyone stays, they may be less enthusiastic about getting the work done each day. The loss of confidence may manifest in lower productivity. That will become a larger issue when it’s time to get ready for the next peak season.

Overcome The Problem With Help From Payro

The most pragmatic solution to shortfalls during a slow season is to secure funding that will ensure you have the money to pay all of the employees without fail. Thanks to a Payro business loan for payroll purposes, dealing with temporarily reduced revenue won’t be an issue. It’s possible to keep operating and pay off the obligation using terms that fit easily into the company budget.

With funding through Payro, there’s no complicated application process. The answers to a series of straightforward questions, along with copies of a few key documents, is all that you need. In terms of funding, you’re likely to find the Payro solution one of the easiest financial transactions that you’ve ever made.

Another point in favor of Payro is how quickly the financing can be in hand. Once approved, funds transfers begin at once. While the speed with which your bank posts transactions will have some impact, it’s not unusual for the money to be in the designated account by the following business day.

Flexible repayment plans are also a hallmark of Payro. This is great news for you, since it’s possible to structure the plan for settling when a peak season returns, and your revenue is once again higher.

Last, Payro does not penalize clients who pay off their financing early. If you’ve ever obtained funding and found that you were paying full interest even if you settled the debt well before the due date, or if you had to pay some sort of fee or charge for early repayment, this is something you will appreciate. With Payro, paying off whatever remains on the funding stops the accrual of interest immediately.

Contact Us Today

You own an agriculture company that does a lot of good for your clientele. The last thing that needs to happen is losing the business because of seasonal fluctuation. When all of your advance planning still leaves you with concerns about covering payroll, don’t let the problem undermine the enterprise. Instead, turn to Payro and get the financing needed to ensure there’s money to pay all of your employees on time.

As your payroll financing company, Payro is dedicated to providing what you need to manage until the next peak season. Talk with us about our financing options and how they work. Explore how they differ from what other lenders have to offer. Take a close look at how your payment schedule can be set up, and even at the competitive interest rates we offer. We’re confident that we will convince you that we’re the place to turn for help with payroll funding.

Try us once and see what you think. Use the entire term to repay the balance or pay it off earlier if you like. After seeing how this approach to funding worked so well, there will be no question of where to turn the next time that you need funding to cover the payroll.

Morris Reichman

hello@payrofinance.comMorris Reichman is the founder and CEO of Payro Finance. Former Vice President at Infinity Capital Funding an alternative finance company, Morris possesses a versatile background in the finance industry. Having spent 7+ years working across global macro operations and start up corporate finance Morris's expertise is in business accounting, risk management and investment analysis. Morris founded Payro Finance to support business owners and ensure their business continuity.

Need a short-term loan to cover payroll?

Apply in under two minutes, and get approved within 2 days. Once approved, funds are in your account the same day.

- Always 1.5% weekly

- Up to $500,000

- Same-day funding